jk-ostafevo.ru

Prices

Debt Fix Pros

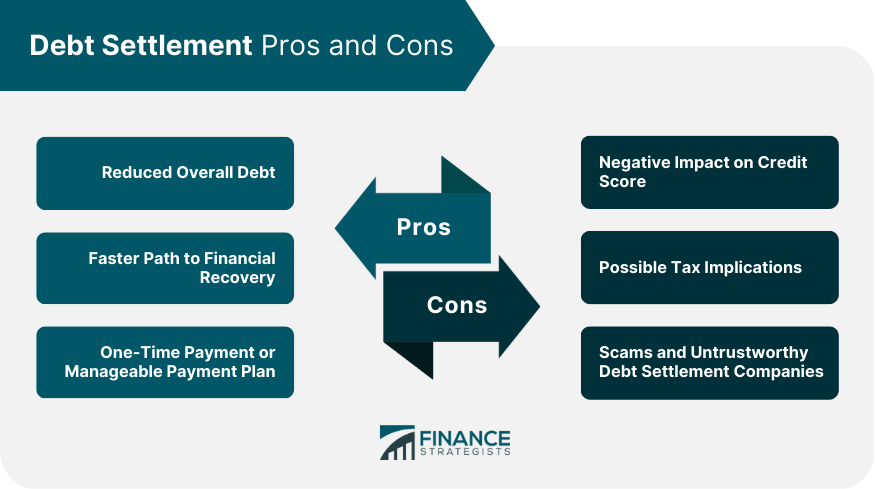

Debt settlement can reduce the amount you owe and shorten the length of paying off the debt. Other benefits include: · Avoiding bankruptcy · Saving money · Saving. A debt consolidation loan allows you to combine multiple higher-rate balances into a single loan with one set regular monthly payment. It is one of several. Looking for the best company for debt consolidation? We've helped thousands of Australians! Have a look at testimonials from Debt Fix's satisfied customers. If you are struggling with credit card debt, ClearOne Advantage has expertise and resources to help you achieve debt relief with a payment you can afford. Only time will repair your credit report-specifically, the seven years it takes until the credit bureau must, by law, remove the debt notation. To find out. debt consolidation, home renovations, a new car and more; You can split your mortgage and enjoy the advantages of both variable and fixed rates. Debt. Credit counseling can help you create a debt management plan, which allows you lump all of your debts into a single monthly payment — often at a lower interest. So if you can't pay off the settled debts, then NDR isn't a bad option. It will keep your credit tanked for longer if going with NDR. Probably 2. Advantages of Debt Settlement · Getting Relief From Overwhelming Debts · Paying Off Your Debts in Less Time · Avoiding Bankruptcy. Debt settlement can reduce the amount you owe and shorten the length of paying off the debt. Other benefits include: · Avoiding bankruptcy · Saving money · Saving. A debt consolidation loan allows you to combine multiple higher-rate balances into a single loan with one set regular monthly payment. It is one of several. Looking for the best company for debt consolidation? We've helped thousands of Australians! Have a look at testimonials from Debt Fix's satisfied customers. If you are struggling with credit card debt, ClearOne Advantage has expertise and resources to help you achieve debt relief with a payment you can afford. Only time will repair your credit report-specifically, the seven years it takes until the credit bureau must, by law, remove the debt notation. To find out. debt consolidation, home renovations, a new car and more; You can split your mortgage and enjoy the advantages of both variable and fixed rates. Debt. Credit counseling can help you create a debt management plan, which allows you lump all of your debts into a single monthly payment — often at a lower interest. So if you can't pay off the settled debts, then NDR isn't a bad option. It will keep your credit tanked for longer if going with NDR. Probably 2. Advantages of Debt Settlement · Getting Relief From Overwhelming Debts · Paying Off Your Debts in Less Time · Avoiding Bankruptcy.

Advantages of Debt Settlement · Getting Relief From Overwhelming Debts · Paying Off Your Debts in Less Time · Avoiding Bankruptcy. Our certified Credit Counsellors will review your debt situation, discuss your options, and take the time to explain the pros and cons of each. fix it. Consolidate higher interest debt or fund larger expenses like a home remodel. Get Started. The Benefits of the NEA Personal Loan®. No Hidden Fees. No. The benefit is that you have one payment, typically the rate charged is below your credit card interest rate and you have a fixed payment (not. There's a lot to consider with debt solutions, especially how it will impact your credit score negatively. MMI is a full-service organization that also supports. Advantages. It relieves stress and anxiety. It allows you to make a fresh start after a year. Your debts are written off if you have no assets. Most creditors. America's Leading Provider for Debt Relief Solutions · Get a lower monthly payment · Checking rates won't impact credit score · No upfront fees and no obligation. For debt reduction to have a tangible impact on poverty, the additional money needs to be spent on programs that benefit the poor. Before the HIPC Initiative. There are quite a few benefits to debt consolidation. Ideally, you Debt consolidation isn't a quick fix. Whichever method you choose, you need. 0% APR credit cards, which allow consumers to pause interest for a limited time, are another version of debt consolidation offered by credit card companies. How Does Debt Relief Work? · Interest rate reductions · Changes to credit card or loan repayment terms · Reducing the principal amount owed · Consolidating debt. Good credit counselors spend time discussing your entire financial situation with you before coming up with a personalized plan to solve your money problems. By extending the loan term, you may pay more in interest over the life of the loan. By understanding how consolidating your debt benefits you, you will be in a. Advantages of a Debt Consolidation Loan · You only have one monthly payment to worry about · You often consolidate at a lower interest rate which saves you money. You could save up to $3, by consolidating $10, of debt · Quick funding · Bad credit · Borrowing experience · Excellent credit · Competitive rates · Good credit. New Era Debt Solutions helps clients reduce their debt obligations. Consumers with over $10, in unsecured debt would qualify, making the company a good. Companies look for debt consolidation when demands from their existing loans become untenable. Consolidating their debt allows business owners to lower their. Benefits of Credit Counseling: · Provides professional guidance: When you take part in credit counseling, you work with trained credit counselors. · Personalized. Benefits. Beyond the tangible reduction in debt, the benefits of debt settlement are manifold. Enjoy a renewed sense of financial freedom, steer clear of the. A debt relief program is designed to help you manage your debt more effectively. Several forms of relief are available, including debt consolidation, debt.

The Best Work

THE DREAM TEAM · Selflessness — you are humble when searching for the best ideas; you seek what's best for Netflix, not yourself or your team; you take time to. In this article, you'll get a list of the 12 best industries to work within in Here we've defined “best” using the median years of tenure data. Public employment is the most likely to pay fairly and have good work-life balance. If you also have pension and/or union that's even better. Remote-Only Job Boards · 1. FlexJobs · 2. We Work Remotely · 3. Arc · 4. Jobspresso · 5. jk-ostafevo.ru · 6. JustRemote · 7. Virtual Vocations · 8. Remotive. Synchrony is the BEST place to work. They are fair to the employees, offer great benefits, our leaders are easy to talk to, and truly care for the employees. And that's why we've gathered our all-time best career advice. From starting out at the bottom of the totem pole to advancing to a more senior position. Employees have spoken! Here are the Best Places to Work in , according to employees. Discover if your company made it, and join the conversation! The 50 Best Companies to Work For. As Rated by the Women Who Work There (August ) · 1. Bread Financial · 2. Union Pacific · 3. InfoTrust · 4. RS Americas. The government-wide Best Places to Work employee engagement and satisfaction score is out of , a point increase from that reverses the. THE DREAM TEAM · Selflessness — you are humble when searching for the best ideas; you seek what's best for Netflix, not yourself or your team; you take time to. In this article, you'll get a list of the 12 best industries to work within in Here we've defined “best” using the median years of tenure data. Public employment is the most likely to pay fairly and have good work-life balance. If you also have pension and/or union that's even better. Remote-Only Job Boards · 1. FlexJobs · 2. We Work Remotely · 3. Arc · 4. Jobspresso · 5. jk-ostafevo.ru · 6. JustRemote · 7. Virtual Vocations · 8. Remotive. Synchrony is the BEST place to work. They are fair to the employees, offer great benefits, our leaders are easy to talk to, and truly care for the employees. And that's why we've gathered our all-time best career advice. From starting out at the bottom of the totem pole to advancing to a more senior position. Employees have spoken! Here are the Best Places to Work in , according to employees. Discover if your company made it, and join the conversation! The 50 Best Companies to Work For. As Rated by the Women Who Work There (August ) · 1. Bread Financial · 2. Union Pacific · 3. InfoTrust · 4. RS Americas. The government-wide Best Places to Work employee engagement and satisfaction score is out of , a point increase from that reverses the.

10 best work from home jobs requiring no experience · Virtual Assistant · Data Entry Clerk · Customer Service Representative · Social Media Manager · Writer. Best Workplaces · These Employers Have Cracked the Code for Excellent Company Culture. Here's How They Do It. In this article, we will look into some of the best companies to work for without a college degree. Here are the best jobs of Nurse Practitioner; Financial Manager; Software Developer; IT Manager; Physician Assistant; Medical and Health Services Manager. Top 10 · 1. Hilton Worldwide Holdings · 2. Cisco Systems · 3. Nvidia · 4. American Express · 5. Synchrony · 6. Wegmans Food Markets · 7. Accenture · 8. Marriott. Top 10 · 1. Hilton Worldwide Holdings · 2. Cisco Systems · 3. Nvidia · 4. American Express · 5. Synchrony · 6. Wegmans Food Markets · 7. Accenture · 8. Marriott. The 50 Best Companies to Work For. As Rated by the Women Who Work There (August ) · 1. Bread Financial · 2. Union Pacific · 3. InfoTrust · 4. RS Americas. Best Places to Work is an awards program that gives recognition to companies who offer the best total rewards programs and compensation packages among their. Are you a parent on the hunt for a great job that you can do from home? Check out these full-time and part-time stay-at-home jobs for moms and dads! This article shares some of the highest-paying freelance jobs and the benefits of showcasing your skills and expertise. The Best Place to Work: The Art and Science of Creating an Extraordinary Workplace [Friedman PhD, Ron] on jk-ostafevo.ru *FREE* shipping on qualifying offers. Access hand-screened remote jobs on FlexJobs, the #1 site for remote, work from home, and flexible jobs since Career Aptitude Test. Take our free career test to determine what jobs are best suited to your skills and interests. The test is composed of four brief. It's a bit of a fallacy that remote jobs don't pay well. In fact, well-qualified professionals with the right skills and experience can often find great. What is the ratio of the state tipped minimum wage to the regular minimum wage? Table of state rankings | Methodology | Report. The Best States to Work Index. The 30 Best Work-From-Home Jobs in · 1. Web developer · 2. Software developers · 3. Data scientist · 4. Machine learning engineer · 5. Graphic designer · 6. The Index reveals which of the world's top 60 GDP countries have the best work-life balance in Top Cities in the Ranking for Work-Life Balance: 1: Helsinki Finland 2: Munich Germany 3: Oslo Norway 4: Hamburg Germany 5: Stockholm Sweden. Tuesday allows me to 'ease' myself back into the social aspect of the office. On a WFH Monday, I clear work that's come in over the weekend. An. Who should you pick as your best references? · Answer specific questions about you and your work because they know you well enough · Speak to your experience.

Credit Card Companies That Use Fico 8

Your FICO ® Scores are based on your credit decisions and your credit decisions only — as captured in your credit reports. Every time you open a credit card or. FICO Score-Experian; FICO Score-Equifax; FICO Score-TransUnion. And there are different FICO score models in use: FICO 8; FICO 9. Some are used by credit card companies, others by mortgage lenders or auto loan providers, and each weighs factors in your credit history slightly differently. The Role of Credit Reporting Companies: All three major credit reporting companies—Equifax, Experian, and TransUnion—frequently use FICO Score 8 for their. I am also considering the Citibank double card (since I have a good standing $ credit limit citi double card as an authorized user on my. Your FICO® Score is calculated based on data from your Equifax® credit report using the FICO® Bankcard Score 8 model and may be different from other credit. FICO Score 8 is the most commonly used. But the version may vary by lender and credit product, like applying for a credit card versus financing a car. In. Applying for a credit card? You will likely want to know your FICO® Bankcard Scores or FICO® Score 8, the score versions used by many credit card issuers. There are "base" FICO® Scores that the company makes for lenders in multiple industries to use, as well as industry-specific credit scores for credit card. Your FICO ® Scores are based on your credit decisions and your credit decisions only — as captured in your credit reports. Every time you open a credit card or. FICO Score-Experian; FICO Score-Equifax; FICO Score-TransUnion. And there are different FICO score models in use: FICO 8; FICO 9. Some are used by credit card companies, others by mortgage lenders or auto loan providers, and each weighs factors in your credit history slightly differently. The Role of Credit Reporting Companies: All three major credit reporting companies—Equifax, Experian, and TransUnion—frequently use FICO Score 8 for their. I am also considering the Citibank double card (since I have a good standing $ credit limit citi double card as an authorized user on my. Your FICO® Score is calculated based on data from your Equifax® credit report using the FICO® Bankcard Score 8 model and may be different from other credit. FICO Score 8 is the most commonly used. But the version may vary by lender and credit product, like applying for a credit card versus financing a car. In. Applying for a credit card? You will likely want to know your FICO® Bankcard Scores or FICO® Score 8, the score versions used by many credit card issuers. There are "base" FICO® Scores that the company makes for lenders in multiple industries to use, as well as industry-specific credit scores for credit card.

The Equifax credit score model uses a numerical range between and , and FICO score models use a range between and In both cases, higher. It is an inexpensive and main alternative to other forms of consumer loan underwriting. Lenders, such as banks and credit card companies, use credit scores to. Credit card companies; Mortgage, auto loan and student loan lenders; Property Generally, they both use a credit score range of to If you're. using it won't affect your score. The Credit Close-Up app displaying a sample FICO® Score of Enroll to get the full picture of your FICO® Score. Follow. It's very similar to the base FICO 8 score but gives some extra weighting to your track record for handling credit card accounts. What Changed with FICO 8. Applying for a credit card? You'll likely want to know your FICO® Bankcard Scores or FICO Score 8, the score versions used by many credit card issuers. Program participants will receive their FICO® Score 8 based on TransUnion data updated on a quarterly basis, when available. Lenders use FICO Score 9, or any other credit score model, as part of their lenders such as auto loan providers and credit card issuers. FICO Score. credit card company might only look at TransUnion. Although there's no guarantee every lender will use FICO, more lenders are beginning to adopt it. When you apply for a loan or credit card, there's one While there are several different types of scoring systems used to calculate your credit score. Your FICO ® Scores are based on your credit decisions and your credit decisions only — as captured in your credit reports. Every time you open a credit card or. Lenders of home and auto loans, issuers of credit cards, landlords, cell phone companies, and utility companies take your credit score into consideration. 8 or The same thing happens with businesses and lenders who use the FICO score. Some lenders are still using FICO 5. Some have upgraded to FICO 9 or Chase uses Experian, Discover uses Fico, and Capitol One uses Credit Wise. Why is it that they each say a different score? Which one is the most. 90% of top lenders use FICO® Scores– do you know yours? Get your FICO Score, from FICO. Compare your FICO Scores and credit reports from all 3. That's why we're providing a monthly FICO® Score from TransUnion® for free to eligible customers with a consumer credit card†. Not a Bank of America credit card. Most credit card issuers, as well as many auto lenders, use FICO Score 8, but most mortgage lenders use Scores 2, 4, and 5. Auto lenders use Scores 2, 4, 5, 8. You'll likely want to know your FICO® Bankcard Scores or FICO® Score 8, the score versions used by many credit card issuers. Purchasing a home or refinancing an. Your FICO® Score is calculated based on data from your Equifax® credit report using the FICO® Bankcard Score 8 model and may be different from other credit. credit report, information typically sourced from credit bureaus. Lenders, such as banks and credit card companies, use credit scores to evaluate the.

3 4 5 6 7